- Although the services sector has emerged as a new engine of economic growth, the lingering effects of the COVID-19 pandemic have severely affected services exports from the least developed countries (LDCs), with an approximate loss of almost USD 29 billion in foregone exports over the past three years.

- While global services exports have rebounded from the shock of the COVID-19 pandemic, the recovery in the LDCs is lagging, potentially with long-term consequences for achieving the ambitions of the Doha Programme of Action for the LDCs and several Sustainable Development Goals.

- Urgent actions by the LDCs and their trading and development partners to improve utilization of the WTO Services Waiver, incentivize foreign direct investment (FDI) and technology transfer, promote regional trade initiatives, leverage Aid for Trade, and address the digital divide can help reverse this trend, enabling the LDCs to benefit from a services-led transformation.

Deeper scars of the pandemic on LDCs’ services exports

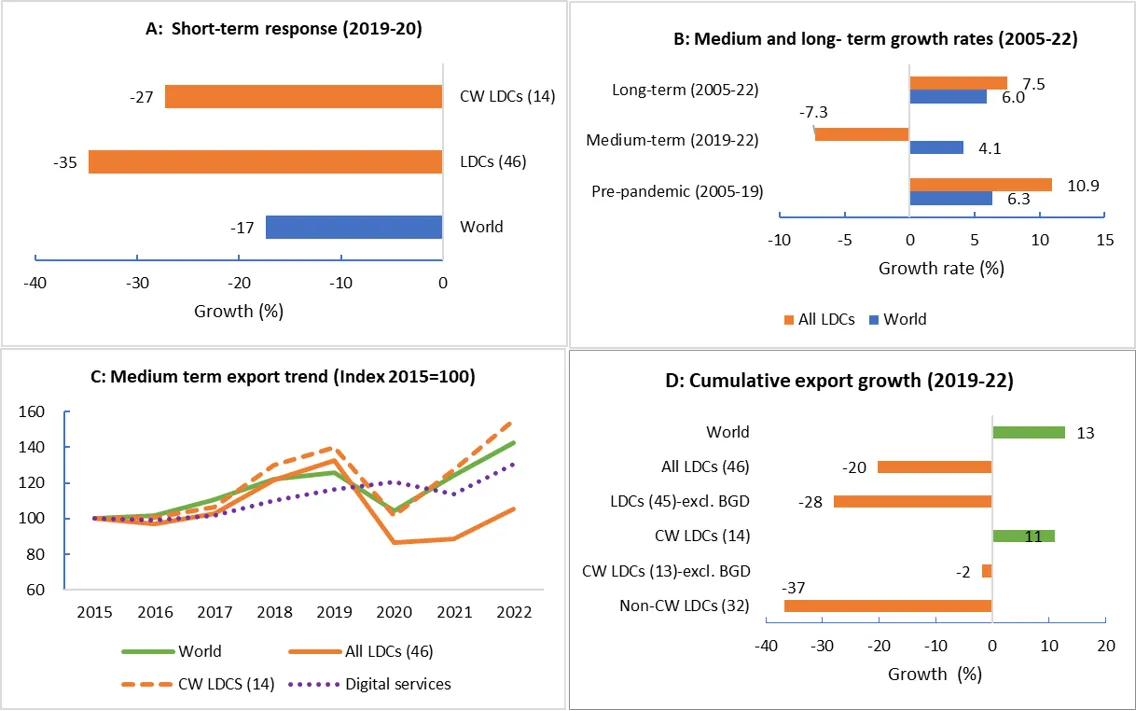

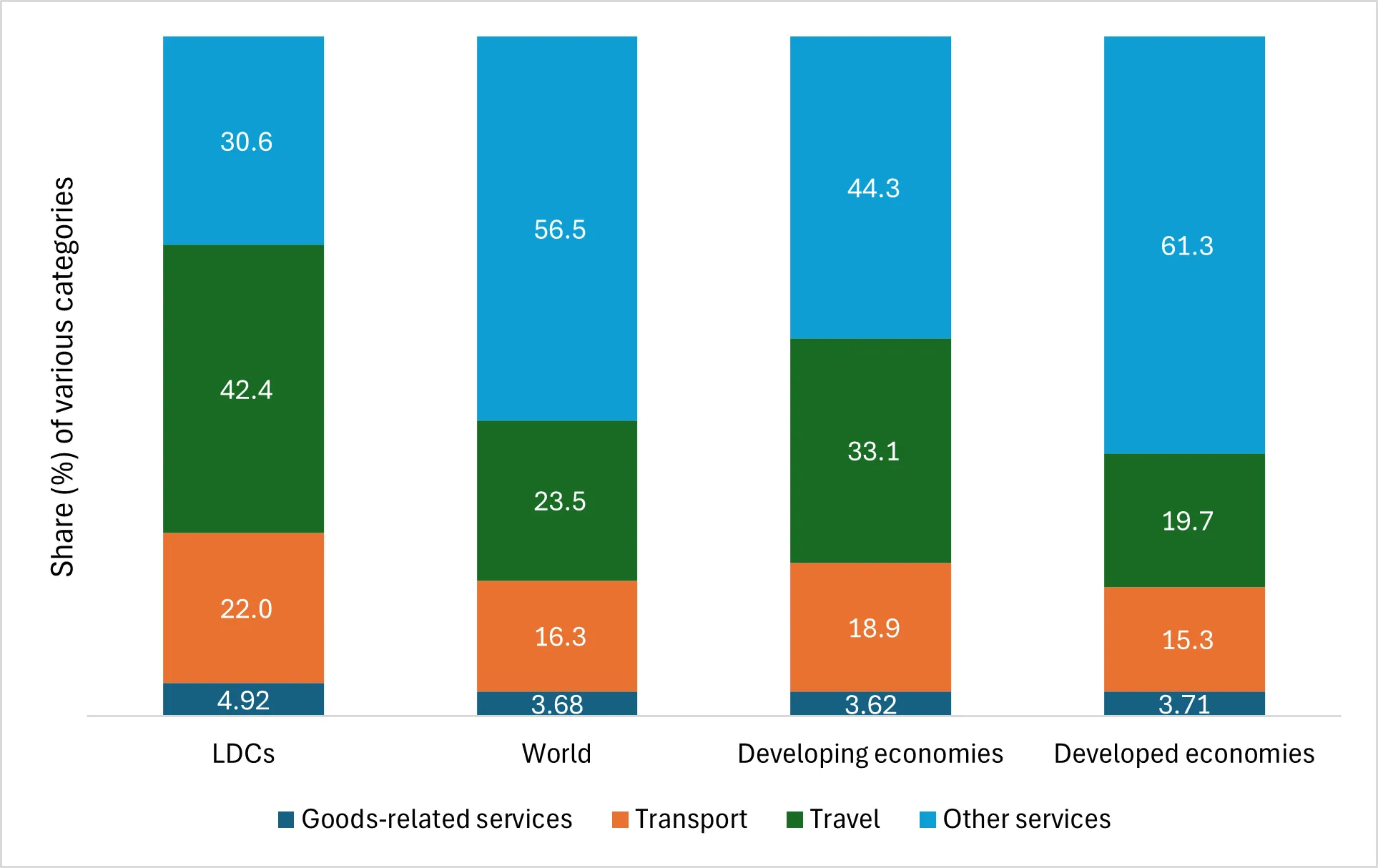

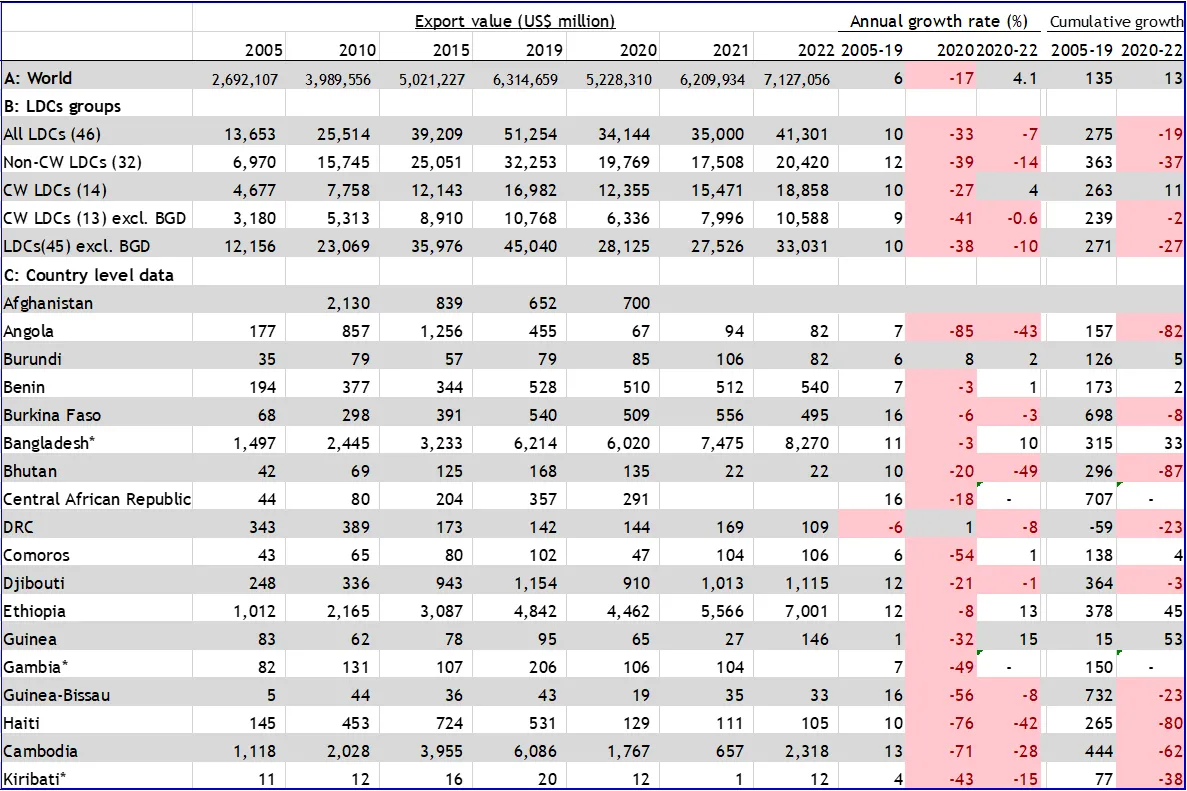

The COVID-19 pandemic severely impacted the services sector of the 46 LDCs[1]. Their services exports collapsed by 35%, over twice the decline in global services exports (Figure 1, Panel A). This downturn in the LDCs was uniquely tied to the pandemic, as before its onset, LDCs’ services exports (11%) were outpacing the global average growth rate (6.3%) (Table A1). This occurred owing to the LDCs' relatively larger reliance on travel and transport services (at 32% and 29%, respectively). Exports from both these sectors almost came to a halt during the pandemic. On the contrary, most developed and developing countries have a large share of other services (such as ICT services, insurance, finance, and research and development (R&D) services); exports from these sectors experienced a relatively lower dip compared to the travel and transport sectors (Figure A1).

Figure 1. Impacts of the COVID-19 pandemic on LDCs’ services exports

Source: Authors (using the WTO services trade dataset)

Note: CW=Commonwealth; BGD=Bangladesh; two sub-groups on the chart ‘D’ [LDC (45) and CW LDC (13)] exclude Bangladesh because of its outlier status in services export growth, compared to other LDCs. Bangladesh’s faster growth masks the underlying declining trend at the aggregate levels.

Beyond the significant initial impact, the knock-on effects on LDCs’ services exports were considerably more severe. While global services exports quickly recovered, surpassing pre-pandemic levels by 13% (or USD 807 billion) in 2022, services exports for the LDCs remained 20% below the pre-pandemic level (Figure 1, Panel D).

The medium-term effects: USD 29 billion of foregone exports

From 2005 to 2019, LDCs’ services exports witnessed a growth rate nearly double that of the global services sector. By 2019, these exports had reached a peak of USD 49.2 billion, raising the LDCs’ share in global services exports from 0.44% in 2005 to 0.79% in 2019. The pandemic abruptly disrupted this upward trajectory, erasing the export gains accumulated over several years.

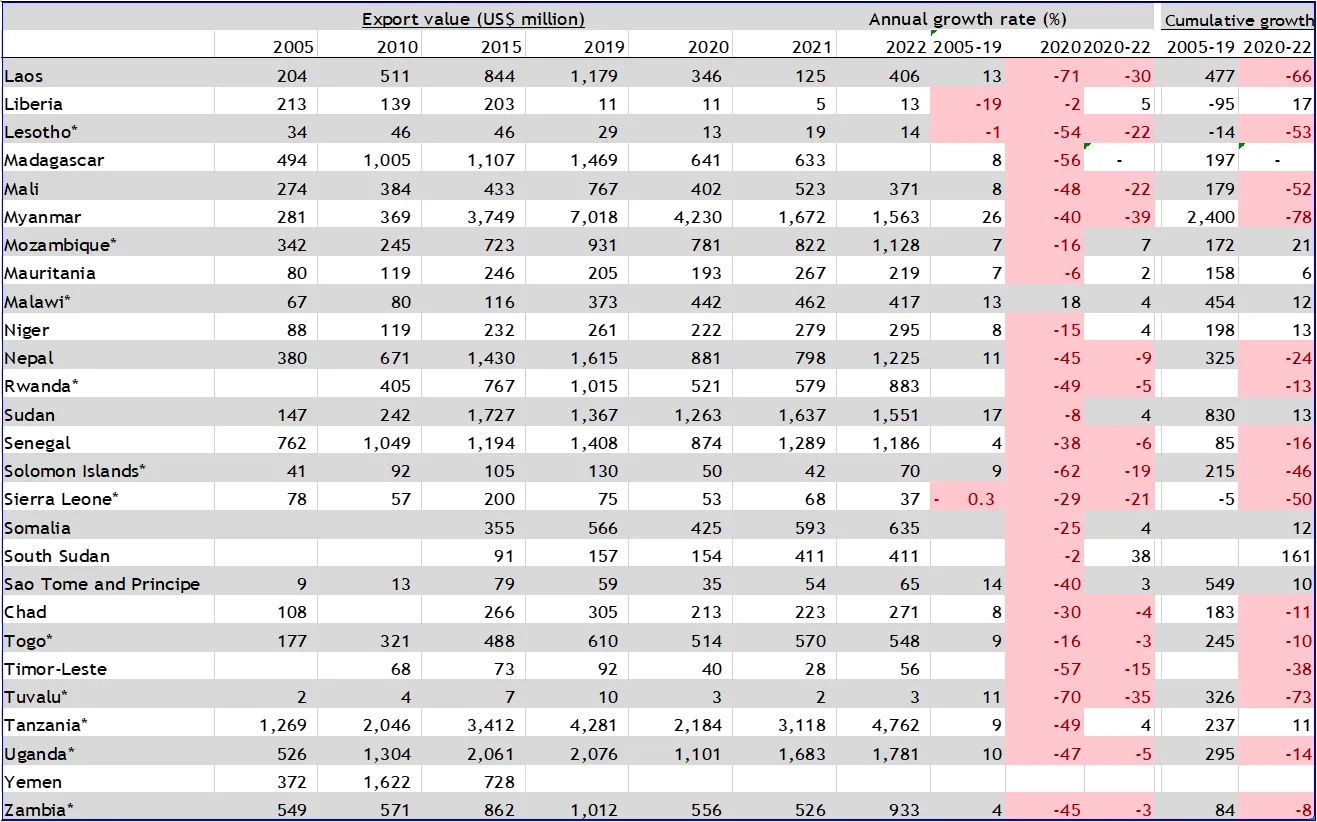

In 2022, the combined value of services exports from the 46 LDCs was 20% (or USD 10 billion) lower than the 2019 figure, and their share in global services exports fell to 0.56%. 28 LDCs experienced negative growth in services exports from 2019 to 2022. This decline becomes even more pronounced, reaching 28%, when excluding the services exports from Bangladesh. In terms of sectoral composition, exports from all four key sectors[2] experienced a drop, with the largest decline observed in the transport and travel services. LDCs' exports of other services[3] also underwent a decline of 9%, although this sector grew globally by 1% during the pandemic.Top of Form

Had the services exports of the LDCs followed the global average rebound, their value could have reached USD 67.5 billion by 2022. The lingering effects of the pandemic have taken a substantial toll, resulting in an approximate loss of almost USD 29 billion in foregone exports over the past three years.

Services exports rebound in most Commonwealth LDCs

In contrast to the delayed recovery in 32 non-Commonwealth LDCs, the 14 LDCs that are members of the Commonwealth demonstrated a slightly more mixed export performance:

- During 2020, their services exports experienced slightly lesser decline at 27% compared to 39% for the other 32 LDCs (Figure 1, Panel A). Notably, this was due to a smaller decrease in Bangladesh’s services exports (3%), the largest services exporter among the LDCs, and the positive growth registered by Malawi.

In the medium term (2020-2022), the services exports of most Commonwealth LDCs rebounded. By 2022, their collective exports had surged to 11% above the pre-pandemic level, whereas for the other LDCs, they were still 37% below the 2019 level (Figure 1, Panel D). The travel sector recovered the most, with the largest rebound observed in Bangladesh.

This substantial recovery is also attributed to robust services export growth from Bangladesh, which expanded by 33% during 2019-2022. Furthermore, the impressive export growth from Malawi, Mozambique and Tanzania — each exceeding 11% in this period — contributed to this recovery (Annex 1). Excluding Bangladesh, Commonwealth LDCs experienced a decline of 2% owing to the delayed recovery in The Gambia, Lesotho, Kiribati, Uganda, and Solomon Islands (Figure 1, Panel D).

Five policy measures to reverse this decline

- Improve utilization of the World Trade Organization’s (WTO) LDC Services Waiver: Currently, 51 economies, representing a substantial share of global services trade, provide preferential access to the LDCs' services under the Waiver, yet its practical impact is limited. The Waiver could be more beneficial if it offered improved market access, relaxed regulations, and capacity-building support for the LDCs’ service suppliers.

- Incentivize FDI and technology transfer: New greenfield investments in the services sector can help the LDCs expand their productive capacity and grow their exports by facilitating the transfer of technology and skills, and enabling services suppliers in the LDCs to integrate into regional and global markets.

- Promote regional trade initiatives: Given the increasing significance of regional trade, initiatives such as the African Continental Free Trade Area (AfCFTA) can play a pivotal role because the African continent is home to over 70% (33 of 46) of all LDCs. Similarly, the 12 Asian LDCs can benefit from the Regional Comprehensive Economic Partnership (RCEP). These free trade agreements could also offer opportunities to attract investment and enable services suppliers to participate in regional and global value chains.

- Address the gap between commitment and disbursement for Aid for Trade (AfT): the LDCs should look to leverage resources and technical assistance available through AfT, such as the Enhanced Integrated Framework partnership housed at the WTO, to address their supply-side constraints and enable greater participation in global services trade. AfT can also help the LDCs to build the necessary capabilities to engage more fully in digitally delivered services trade such as ICT services, sales and marketing services, financial services, professional services, and education and training services.

- Narrow the digital divide: Improving digital connectivity, including access to the internet, and improving the affordability and quality of broadband services, can spur the LDCs’ services export growth, as around two-thirds of global services exports globally are now delivered through digital means. Addressing the gender digital divide needs particular attention because the internet access rates are not equal between women and men, with women only 48% integrated into the digital infrastructure of the LDCs compared to 58% of men.

Annex 1

Figure A1 Compositions of services exports in 2019 (share of various sectors)

Source: Authors (using data from UNCTADstat)

Table A1: LDCs’ Services Exports Pre-and Post-Pandemic

Source: Authors (using the WTO services trade dataset)

Note: * Commonwealth LDCs; highlighted cells indicate negative growth rate for countries and regions.

[1] At the time of publishing this article, the number of LDCs has been updated to 45, following Bhutan's graduation from the category on 13 December 2023. However, the data and analysis presented in this article are based on the initial count of 46 LDCs.

[2] Goods-related services, travel, transport and other services.

[3] such as ICT services, insurance, finance, R&D services, etc.

If you would like to reuse any material published here, please let us know by sending an email to EIF Communications: eifcommunications@wto.org.